Corporate Governance

PI Advanced Materials connects people, society, and the world by

realizing the potential of Polyimide

through creative

innovation technology.

Board Composition and Operation Status

The board of directors is the company's highest decision-making body, deliberating and making decisions on matters stipulated in laws or articles of incorporation, matters delegated by the general shareholders' meeting, and important matters regarding the company's management policy and business progress.

Independence of the Board of Directors

PI Advanced Materials' board of directors consists of one

executive director, three outside directors, and three other

non-executive directors. Outside directors account for 43% of

all directors.

The Chairman of the Board of Directors

is elected by the Board of Directors through a resolution in

accordance with the Articles of Incorporation of the Company,

and director candidates are recommended by the Board of

Directors and appointed at a general shareholders' meeting in

accordance with a fair procedure.

Outside directors

have extensive experience and expertise in a variety of fields,

including industry and academia, and have no conflict of

interest with the company, ensuring independence.

Based on our expertise and independence, we are attempting to

establish a sound corporate governance structure by holding

in-depth discussions on all agenda items.

Board of Directors Composition Status

| Division | Name | Specialty | Career | Term of office | Note | |

|---|---|---|---|---|---|---|

| Board of Directors Chairman | Internal Director (CEO) |

Geumsu Song | Management/Sales | Bachelor of Business Administration,

Sogang University Former) Head of Sales, SKCKOLONPI Co., Ltd. Former) Head of Business Division, PI Advanced Materials Co., Ltd. Current) CEO of PI Advanced Materials Co., Ltd. |

2023-03-23 ~ 2026-03-22 |

Composed of experts in a variety of fields, including management, finance, sales, accounting, and engineering. |

| Director | Outside Director | Jaeho Yang | Legal | Columbia Law School (LL.M., 2011) Current) Lawyer at Kim & Chang Law Firm |

2023-03-23 ~ 2026-03-22 |

|

| Jewon Lee | Legal | SJD from Indiana University School of Law Current) Lawyer at Gwangjang Law Firm |

2023-03-23 ~ 2026-03-22 |

|||

| Hyungil Oh | Accounting | PhD in Accounting, Columbia University Current) Professor of Accounting, Department of Management Engineering, KAIST Business School |

2023-03-23 ~ 2026-03-22 |

|||

| Other Non-Excutive Director | Marc Henri Florent SCHULLER | Management | Former)Arkema S.A. Executive Vice

President Current) Arkema S.A. COO |

2023-12-01 ~ 2026-03-22 |

||

| Marie Jose DONSION | Finance/Accounting | Former) Alstom SA Finance Senior Vice

President 前)Alstom SA CFO 現)Arkema S.A. CFO |

2023-12-01 ~ 2026-03-22 |

|||

| Hyunsu Han | Management | Former) Arkema Co., Ltd. HR/GA/PSRA

Director Current) Arkema Co., Ltd. President |

2023-12-01 ~ 2026-03-22 |

Board of Directors with diversity

For sustainable growth, PI Advanced Materials strives to share

profits and values with all stakeholders.

To this

end, considering the diversity and expertise in the composition

of the board of directors, outside directors with expertise in

various fields such as engineering, management,

finance/accounting, and law were appointed during the director

selection process.

Through this, we strive to secure

expertise in the overall aspects of corporate management.

Board skills Matrix

| Division | Name | Specialty | ||||||

|---|---|---|---|---|---|---|---|---|

| Management | Finance | Accounting | Legal | Sales | Engineering | |||

| Chairman of the Board | Internal director (CEO) | Geumsu Song | Check | Check | ||||

| Director | Outside Director | Jaeho Yang | Check | |||||

| Jewon Lee | Check | |||||||

| Hyungil Oh | Check | |||||||

| Other Non-Executive Directors | Marc Henri Florent SCHULLER | Check | ||||||

| Marie Jose DONSION | Check | Check | ||||||

| Hyunsu Han | Check | |||||||

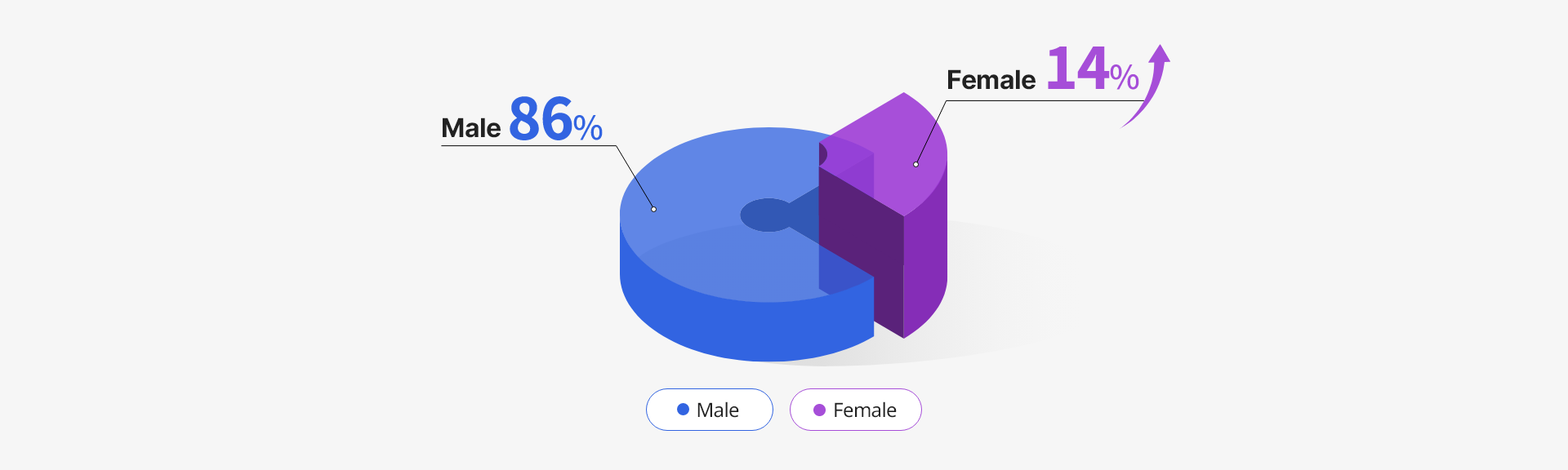

Ratio of female directors on the BOD

Director Evaluation Compensation

PI Advanced Materials executes remuneration within the director

remuneration limit approved at the general shareholders'

meeting in accordance with Article 388 of the Commercial Act

and the Company's Articles of Incorporation. To ensure

independence, no additional performance compensation is paid to

outside directors in addition to the base salary.

Severance pay for directors is also paid in accordance with

executive severance pay regulations determined by resolution at

the general shareholders' meeting.

Status of Director and Auditor Remuneration in 2024

| Division | Number of people | Total remuneration | Average remuneration per person |

|---|---|---|---|

| Registered Director | 4 | 366 | 92 |

|

Outside Director |

- | - | - |

| Audit committee members | 3 | 74 | 25 |

Shareholder Proposal Rights

Pursuant to Article 363-2 of the Commercial Act, our shareholders may propose certain matters as the objectives of the general shareholders' meeting in writing or electronically 6 weeks prior to the date of the general shareholders' meeting (in the case of an ordinary general meeting of shareholders, the relevant date of the year corresponding to the date of the regular general meeting of shareholders of the previous year). In addition, you may request that the matters to be addressed for the purpose of the meeting be added and that the details of the agenda submitted by the relevant shareholder be stated in the notice convening the general meeting of shareholders and the notice of convening the general meeting of shareholders.

Shareholder proposals can be proposed by shareholders who hold

more than a certain percentage of shares.

(Shareholder

proposal authority: Shareholders holding stocks equivalent to

more than 3/100 of the total number of issued stocks, excluding

stocks without voting rights)

If there is a shareholder proposal, the company must report it to the board of directors. The Board of Directors must submit a shareholder proposal as a subject matter for the general shareholders' meeting, except in cases where the content of the shareholder proposal violates laws or the Articles of Incorporation or in the following cases under Article 12 of the Enforcement Decree of the Commercial Act.

- 1. If a bill with the same contents as the one rejected at the general shareholders' meeting because it received less than 10/100 of the voting rights in favor is proposed again within 3 years from the date of rejection.

- 2. In case of matters related to the grievances of individual shareholders

- 3. In case of matters related to minority shareholder rights, where shareholders must hold shares exceeding a certain percentage in order to exercise their rights

- 4. If the matter concerns the dismissal of an executive during his term of office, if the matter cannot be realized by the company, or if the reason for the proposal is obviously false or defames a specific person.

When there is a request from a shareholder who made a

shareholder proposal, the shareholder must be given an

opportunity to explain the proposal at the general

shareholders' meeting.

Other matters shall be governed

by the Commercial Act or other related laws.

Operation Status

The Board of Directors plays an important role in supervising

management, and as a rule, the Board of Directors meets once a

quarter, including the agenda for approving provisional

performance. Additionally, temporary board of directors meetings

are convened when necessary.

A total of 6 board

meetings were held in 2024, during which time decisions regarding

the general shareholders' meeting, management, finances, and

other issues were discussed and made in accordance with the

regulations of the Articles of Incorporation and Board of

Directors.

The strategic department supports the board

of directors in making the best decisions by providing

information and prior reporting on agenda items.

Agenda of the Board of Directors Meeting 2024

| No. | Date of Meeting | Agenda Item | Names of Independent Directors | ||

|---|---|---|---|---|---|

| Independent Directors | |||||

| Hyung Il Oh (Attendance Rate :100%) |

Jae Ho Yang (Attendance Rate :100%) |

Je Won Lee (Attendance Rate :100%) |

|||

| Approval Status | |||||

| 1st | Jan. 5, 2024 | Agenda Item 1 : 2024 Budget | Approval | Approval | Approval |

| Agenda Item 2 : Refinancing of a general-purpose loan from HANA Bank | Approval | Approval | Approval | ||

| Agenda Item 3 : General-purpose loan extension from NH Bank | Approval | Approval | Approval | ||

| 2nd | Jan. 29, 2024 | Report ① Business update for FY 2023 | Present | Present | Present |

| ② Performance for 4Q23 | |||||

| Agenda Item 1: 16th financial statements and business report | Approval | Approval | Approval | ||

| 3rd | Mar. 4, 2024 | Report① Management’s Report on Internal Control over Financial Reporting | Present | Present | Present |

| ② Audit Committee’s Evaluation Report on Internal Control over Financial Reporting | |||||

| Agenda Item 1: Calling the Annual General Meeting | Approval | Approval | Approval | ||

| Agenda Item 2: Adoption of e-voting | Approval | Approval | Approval | ||

| 4th | Apr. 29, 2024 | Report ① Business update for 1Q 2024 | Present | Present | Present |

| ② Performance update for 1Q 2024 | |||||

| ③ Performance outlook for 2Q 2024 | |||||

| ④ Internal accounting PA service selection in 2024 | |||||

| ⑤ CEO individual objectives and compensation package | |||||

| 5th | July. 29, 2024 | Report ① Finance update for 2Q 2024 | Present | Present | Present |

| ② Business update for 2Q 2024 | |||||

| ③ Performance outlook for 2Q 2024 | |||||

| Agenda Item 1: 2Q 2024 reviewed financial statements | Approval | Approval | Approval | ||

| Agenda Item 2 : Change in organizational structure | Approval | Approval | Approval | ||

| Agenda Item 3 : F2 postponement | Approval | Approval | Approval | ||

| 6th | Oct. 31, 2024 | Report ① Finance update for 3Q 2024 | Present | Present | Present |

| ② Business update for 3Q 2024 | |||||

| ③ Performance outlook for 4Q 2024 (incl. FY2024) | |||||

| ④ FX Hedging update | |||||

| Agenda Item 1: 3Q 2024 reviewed financial statements | Approval | Approval | Approval | ||

| Agenda Item 2: Compensation increase for outside directors | Approval | Approval | Approval | ||

IR Contact

Address

04527, PI Advanced Materials, 16th Floor, Grand Central B-dong, Sejong-daero 14, Jung-gu, Seoul, Republic of Korea

Phone

+82-2-2181-8635

kw.han@pimaterials.com